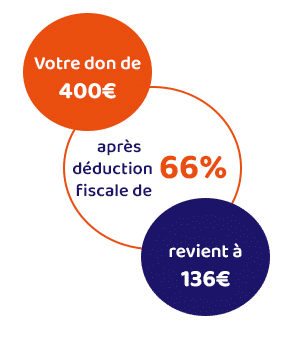

By making a donation to Action Education, you become a player in a more equal world by supporting education. In France, this gesture also allows you to benefit from a significant tax reduction which rewards your commitment. Here are some explanations.

Why is my donation to Action Education tax deductible?

Associations of general interest or recognised as being of public utility, such as Action Education, can issue tax receipts, allowing their donors to obtain a tax reduction.

If you are taxablea donation to Action Education will allow you to deduct :

- 66% of its amount up to 20 % of your taxable income if you are an individual.

- 60% of its amount up to 5 per 1000 of your turnover, or €20,000, if you are a company.

It is important to specify that these donations, which are tax deductible thanks to the tax receipt you receive from Action Education, must be without counterpart.

For example:

- With 90 €, that is really 30,60 €. for you after tax reduction, you finance the school fees of a little Laotian girl in a precarious situation.

- With €140, that is actually €47.60 for you after tax reduction, you raise awareness of the dangers of sexual harassment and unwanted pregnancies among 200 teenagers.

- With 220 €, that is really 74,80 €. for you after tax reduction, you finance the childcare of a young Madagascan mother in professional training.

Make the choice to see your sincere commitment rewarded with a real benefit!

How to benefit from the tax reduction this year?

As you know, we are counting on you to provide the most vulnerable children with quality education. Particularly at this sensitive time. By making a donation before midnight on 31 DecemberYou will be able to register your name with us in this major battle, and benefit from the tax reduction when you file your 2023 tax return on your 2022 income.

How can I justify my donation to Action Education?

In April, Action Education will send you, by post or by e-mail, your tax receipt. This receipt will summarise all your donations made between 1st January and 31st December of the previous year. If you have made several donations to Action Education over this period, the total amount will appear and will be used as the basis for the tax reduction.

When you complete your tax return, and you arrive at the space for declaring your donations to associations or foundations, several box options will be displayed: 7UD or 7UF. To declare your donation in our favour, you will need to fill in box 7UFThis is a tax credit for donations to organisations of general interest and recognised as being of public utility, such as Action Education, with the famous accumulation of your donations in our favour recorded on your tax receipt.

Keep all your receipts for donations to associations in your personal archives in order to be able to prove the payments made in the event of a later audit by the tax authorities.

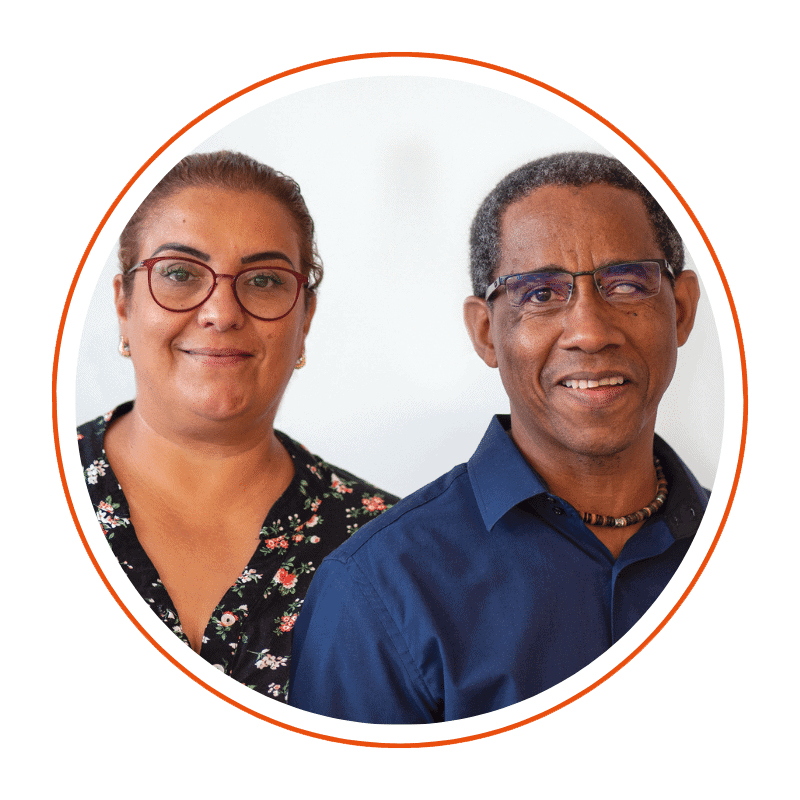

Have a question? Contact the Action Education donor team!

Khadija Hammouti and Jean-Pierre Fidelin will answer all your requests quickly. Do not hesitate to contact them!

Khadija HAMMOUTI and Jean-Pierre FIDELIN

+33 (0)1 55 25 70 00

Action Education France

53, boulevard de Charonne,

75545 Paris Cedex 11

FRANCE